2

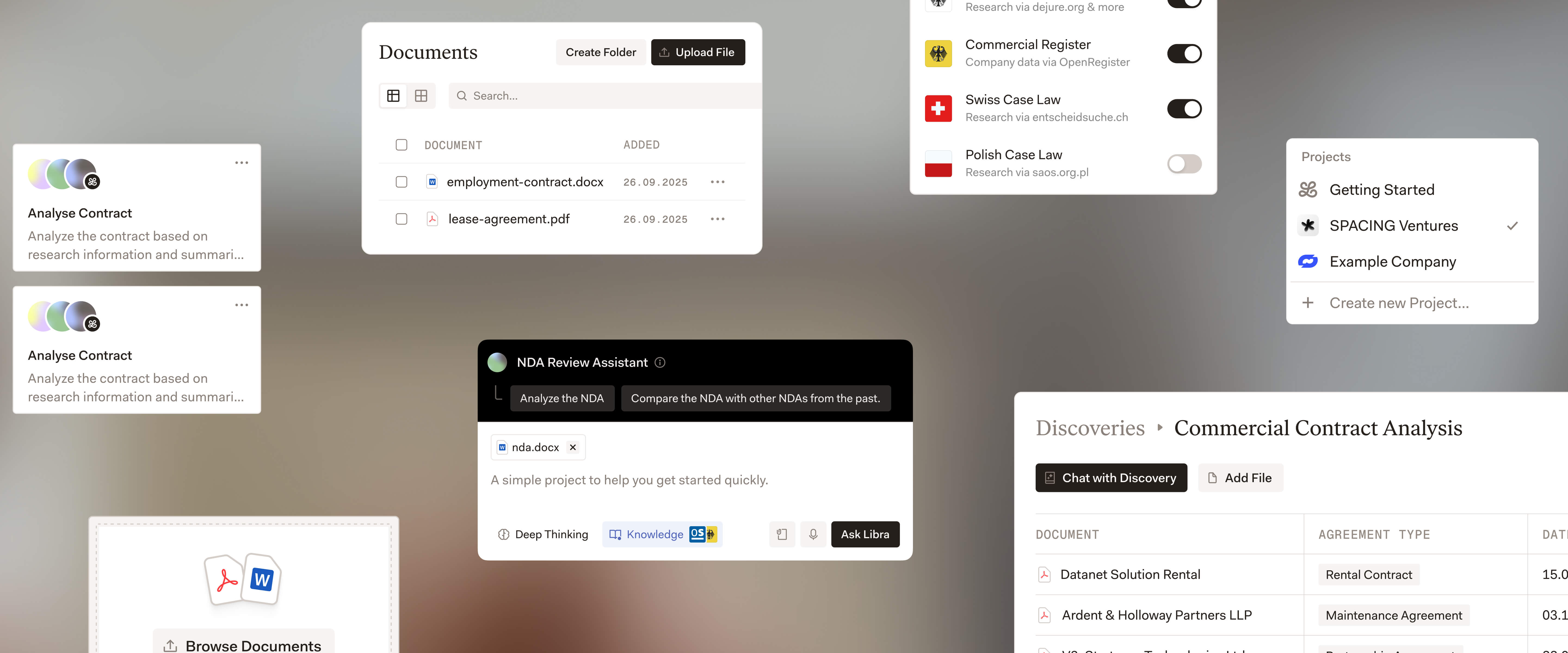

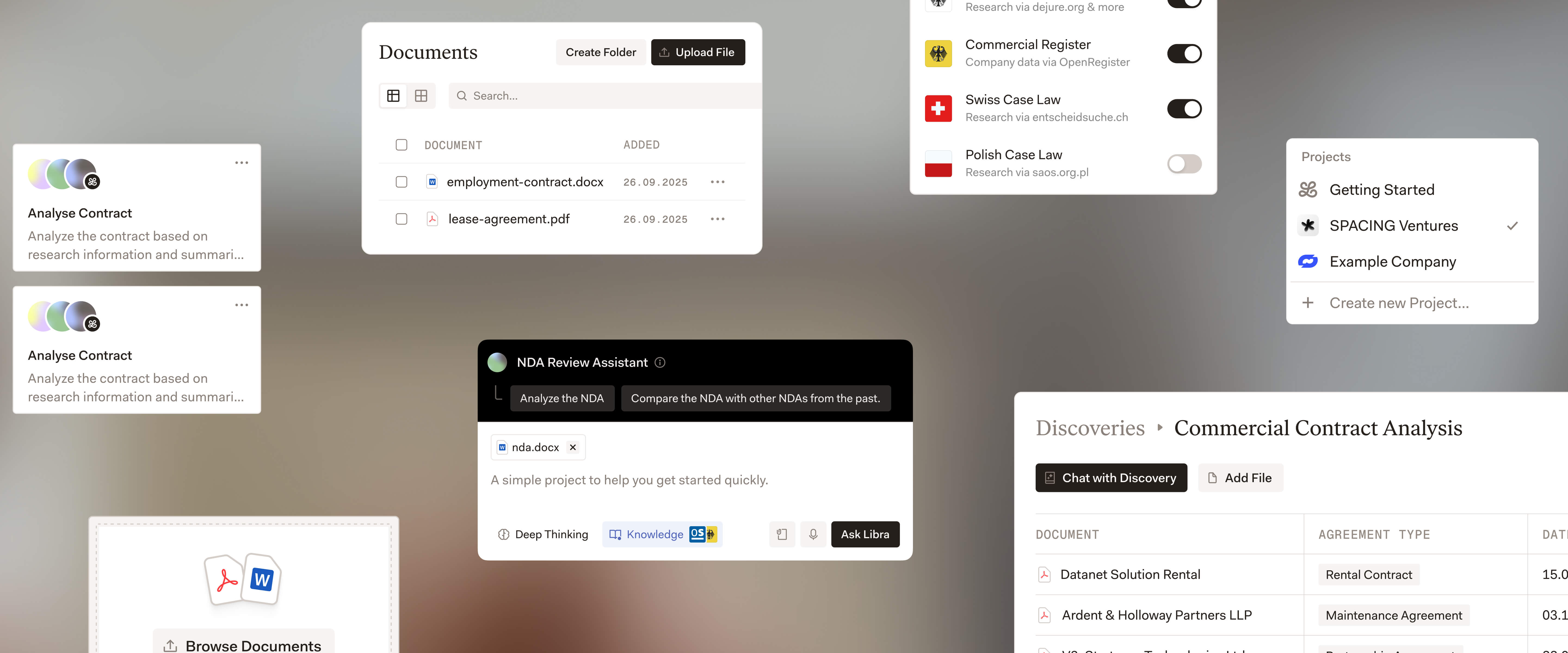

Intelligent Document Processing Upload any purchase contracts, invoices, or receipts — our AI automatically extracts and structures all tax-relevant data in seconds. Digital Tax Brain The “Tax Brain” applies the latest German tax regulations and legal logic (EStG, AfA, GrEStG, etc.) to your real-estate data — ensuring every calculation and deduction is legally grounded. Future Simulation Explore multiple what-if scenarios: refinancing, renovation, selling, or holding. See how different internal or external factors could impact your long-term tax position and ROI. Personalized Recommendations Based on your portfolio, preferences, and goals, the AI suggests optimal tax strategies and investment moves tailored to your situation. Knowledge Coach Get guided explanations, required document lists, and step-by-step instructions on where and how to implement each strategy. Annual Tax Report At year-end, your entire tax data is automatically consolidated and exportable — ready for your tax advisor or direct submission via ELSTER.

THE 1ST AI SMART TAX HELPER FOR REAL ESTATE INVESTORS.

Co-developed by experts in taxation, real estate,

and artificial intelligence.

Video

Product Features

Basic

Ideal for Individuals with up to 3 properties

€30

/ MONTH

or€306

/ YEAR

Perfect for single owners who want a simple, automated way to manage rental tax and documents.

- • Intelligent Documentation Recognition

- • Automated Annual Tax Filing

- • Basic tax dashboard & expense tracking

- • Passive Tax Optimization

Family

2 adults + unlimited children

€52

/ MONTH

or€535

/ YEAR

Ideal for families wanting combined asset management, inheritance planning, and unified tax workflows.

- • Multiple family member accounts

- • Family inheritance planning

- • Intelligent Documentation Recognition

- • Annual Tax Filing (household)

- • Passive Tax Optimization

Advance

Up to 3 holding structures

Up to 12 properties

€105

/ MONTH

or€945

/ YEAR

Designed for advanced investors with multi-layer ownership and more complex tax needs.

- • Up to 3 holding structures

- • Bookkeeping separation

- • Corporate documentation recognition

- • Multi-entity tax filing

- • Advanced tax analytics

Professional

11–50+ properties

More than 3 holding structures

€ Custom

/ MONTH

or€ Custom

/ YEAR

A fully customized, enterprise-level tax solution for larger real estate portfolios.

- • Multi-layer holding management

- • Enterprise invoice system integration

- • Dedicated tax advisor support

- • Corporate asset planning

- • Customized annual filing workflows

3